Agora Outlook

October Expiration

September 26th 1997

Stocks snapped out of a three day losing streak Friday, taking heart from a drop in long term interest rates and satisfying economic news. The Dow gained +74.17, or 0.95% to close at 7,922.18. Bonds, which had fallen sharply Thursday amongst strong economic figures, recouped some of their losses. They rose 12/32 to yield 6.37%, down from Thursday's 6.40%. Prior to the market's opening Friday, the Commerce Department said the economy grew a little less than previously expected during the second quarter.

Gross domestic product, the broadest measure economic activity, grew at 3.3% annual rate in the quarter, down from the 3.6% rate reported a month ago. They said price inflation, though revised upward, remained muted. The Dow took off up +70 points in the first minutes of trading and stayed at those levels for most of the day. There was also spillover momentum from a huge run up in British stocks aiding North American stocks. London's FTSE 100 gained +160.80 points or 3.17% closing at 5226.30 after a report that Britain is likely to join the European economic and monetary union. The pound has been surging against the U.S. dollar of late so this was good news for American stocks. The BBC reported that it has always been a possibility that Britain would join the single currency in 1999 but that it remains an "unlikely" prospect. There has been "no shift" in the government's view about when to join the EMU. The notion that the government is edging closer to early EMU entry was reported in Friday's Financial Times, prompting London stocks to soar to an all time high. That story was cited by an unnamed cabinet minister. The government is still evaluating the timing of EMU entry, and that it all hinges on the expected impact of monetary union on British jobs and exports.

If the government believes EMU would help British jobs and exports, it would be more likely to support early entry.

Economic Effects

Tuesday had Btm Schroeder weekly chain store sales coming in up +0.3% and Johnson Redbook sales up +0.3% A new indicator out spooked the market a bit first thing in the morning. The CPI figure has always been regarded as misleading so the government has been playing with an experimental one. It came out this morning stronger than they would like, +.02%, core rate +.01%. The number is regarded more accurate so maybe inflation isn’t dead yet. This number pulled the steam out of the bond market for the day bringing it down a half point. On Thursday weekly jobless claims came in down -2000 to 306,000. Four week average moved a bit lower to 312,750. The number that brought the market to its knees was the durable goods number out first thing in the morning. The number was expected to be up 8/10ths% but was up +2.7%, excluding transportation +2.0%, excluding defense, +2.8%. This number was much stronger then expected. It appeared that the number was discounted on Wednesday so the downfall didn’t last too long after the initial reaction to sell the market off. Existing housing starts were up a strong 3.3%. They were much stronger than expected and took the market down because of the strength of the market. Another number that was out was the help wanted index coming in lower than expected at 84 from 87. Allan Greenspan watches this number closely so you would have thought it would have lifted the market but it appeared to ignore the number completely. On Friday the final revision to 2nd quarter gross domestic product came out little revised at 3.3%. The price deflator was +1.6%. At 10:00 est. the University of Michigan’s sentiment indicator came out at 106.0, much stronger then expected but today was dedicated to getting the market back to neutrality for the week so the market continued to climb.

Next week’s Economic data

This week is chalk full of economic indicators. Monday has personal income and savings out. This number could strongly influence the overall market as everyone will already be on edge with the FOMC meet’s on Tuesday to decide about interest rates. On Tuesday we get weekly chain store sales reports. These numbers have become commonplace of late so they shouldn’t have much of an effect on the market. Also out are new home sales and consumer confidence. Of course reaction to the numbers could be delayed until after the FOMC meeting is finished at 2:15pm est. It will be interesting to see how fast the new predictions come out for the October meeting. Last month it only took 15 minutes before we heard the new predictions. The first indicators out after the meeting are on Wednesday having construction spending and the national association of purchasing managers survey. Both of these numbers could rapidly change anybody’s idea of where interest rates could be headed. Thursday has weekly jobless claims and the factory orders numbers. Factory orders may be a big influence if the number is strong in the opposite direction of what everyone is expecting. Friday has the all important unemployment report and leading indicators with the leading inflation index out. The unemployment number may have already been looked at by the Fed on Tuesday even though no one will admit that they may get to see a preliminary number. All of these numbers will be the focus of the week outside of the FOMC meeting on Tuesday. But Tuesday will be the big day of the week even though the last few months have seen quiet days whenever the Fed has met as everyone has been so accurate in predicting the outcome. Overall, no one expects an interest rate change but we’ll go out on a limb here and say that with all of the strong indicators out of late and rising oil prices that we could see a rate rise here!

Technically

The market is continuing in an oversold to neutral reading this week. Technicals were little changed from last week but this may have been because it was one of the most boring and flattest weeks of the year!

29% of all the trading days this year have experienced either 1% up or down moves. Since 1945 all the years that have had high volatility have signalled a change in the market. Such as 1982, 1987, 1990. When volatility rose considerably in the Japanese Nikkei in 1989 it was the peak in their market. The one factor that has confirmed all of the downturns were a change in short term interest rates. So far interest rates are low this year so it will be important to watch them if volatility continues to rise.

Mclellan Oscillator: n/a -100 oversold +100 overbought

Summation Index: n/a

Five day arms: 1.01 .80 and below, overbought 1.00 and above, oversold

Ten day arms: .97 .80 and below, overbought 1.00 and above, oversold

Bulls: 41.5 previous week 39.0 50% plus overbought/bearish

Bears: 34.1 previous week 35.8 50% plus oversold /bullish

Correction: 24.4 previous week 25.2

Five day Qvix: 23.79 10-15 bullish, low volatility 15-40 bearish, high volatility

Davidson’s View

Despite Friday's gain, the Dow rose only 4.91 points for the week. It was the lowest weekly point gain in over 6 months. I remember saying that it was going to be flat this week but I didn’t think I was going to be that accurate. The present market is like a herd of cows grazing in a pasture. Everyone is waiting for third quarter results and to see if the Fed is going to raise rates on Tuesday. Although I love flat markets for the program sometimes it makes it hard to be able to comment on anything. Maybe I can get a Louis Rukeyser thing going here. Whenever he goes on holidays the market tanks! Maybe if I don’t make any comments the market will stay flat! I will have lots to say after the FOMC finishes their meeting on Tuesday so I’ll see you then!

MARKET CLOSES

| Index | Last Week | This Week | Change | Percent |

| Dow Jones | 7917.27 | 7922.18 | +4.91 | 0.6 |

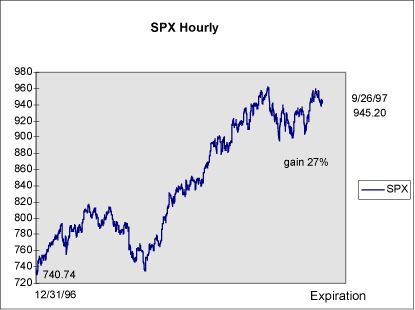

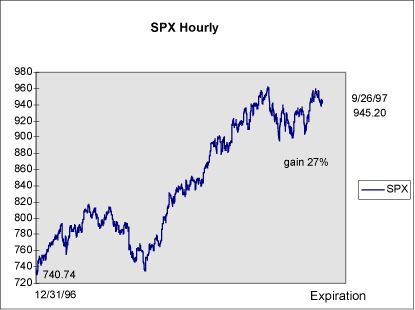

| S & P 500 | 950.50 | 945.20 | -5.30 | 0.5 |

| S & P 100 | 916.40 | 913.57 | -2.83 | 0.3 |

| 30 Year Bond | 6.37% | 6.37% | ||

Current Trades

This week went pretty well filling this months trades. On Monday we had the 990, 995 call trades filled. On Tuesday and Wednesday most of the 900, 895 put trades were filled. Our new altra conservative trade was also filled, 1005,1010 October calls. As we expected the market was flat all week, giving us a lot of premium decay in our trades!

Program Trades

| Average Entry Price | This weeks bid, ask, close |

| 1010 Call $2.69 | .69 .93 .88 |

| 1005 Call $3.25 | 1.06 1.31 1.18 |

| 995 Call $6.00 | 1.88 2.00 2.37 |

| 990 Call $7.13 | 2.25 2.75 2.38 |

| 900 Put $6.13 | 5.00 5.50 5.13 |

| 895 Put $5.45 | 4.62 4.75 4.62 |

Copyright c 1996. All rights reserved. The information contained in the AGORA OUTLOOK NEWSLETTER is based upon data that is believed to be accurate, but is not guaranteed, and subject to change without notice. All projections, forecasts, opinions, and track records cannot be guaranteed to equal our past performance. Persons reading this newsletter are responsible for their actions. Officers and employees of this publication may at times have a position in the securities mentioned, or related services.